Keeping track of finances in the fast-paced world of today can be difficult. From unexpected expenses to fluctuating income, staying on top of your finances requires careful planning and timely decision-making. This is where the Brigit app comes in—serving as your ultimate financial companion, offering solutions to ease your financial burdens, and empowering your monetary management.

Table of Contents

What is the Brigit App?

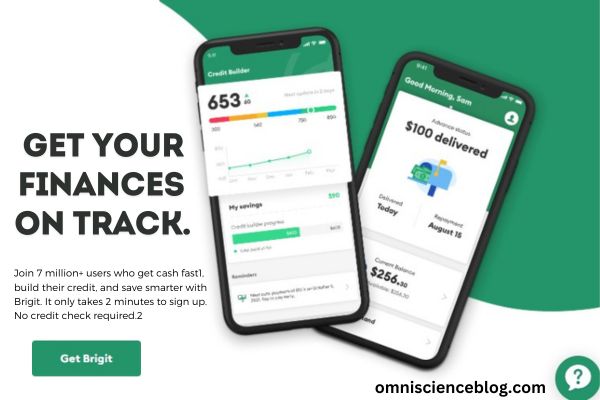

The Brigit app is a financial tool designed to provide users with peace of mind by offering access to instant cash advances, budgeting tools, and financial insights. Whether you’re facing an unexpected bill, need extra cash to cover expenses until your next paycheck, or simply want to better understand your financial habits, Brigit is there to help.

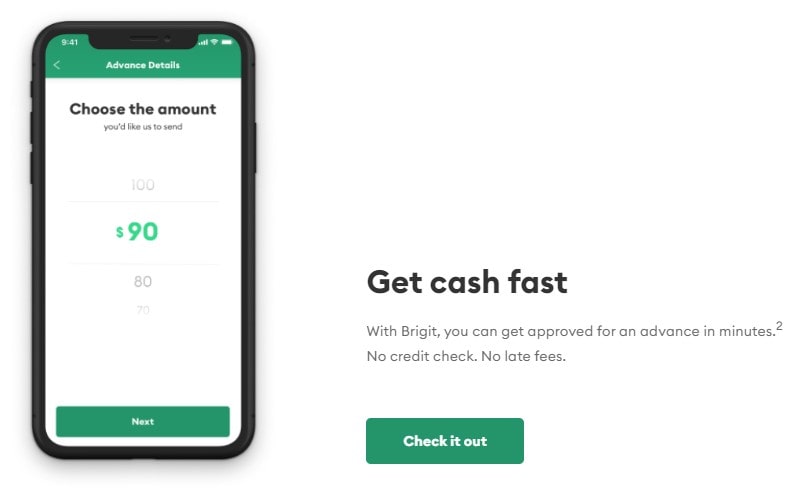

Instant Cash Advances

One of the standout features of the Brigitte app is its ability to provide instant cash advances to users in need. By connecting your bank account to the app, Brigit analyses your spending patterns and income to determine your eligibility for cash advances. This ensures that you can access funds quickly and without the hassle of traditional loan applications.

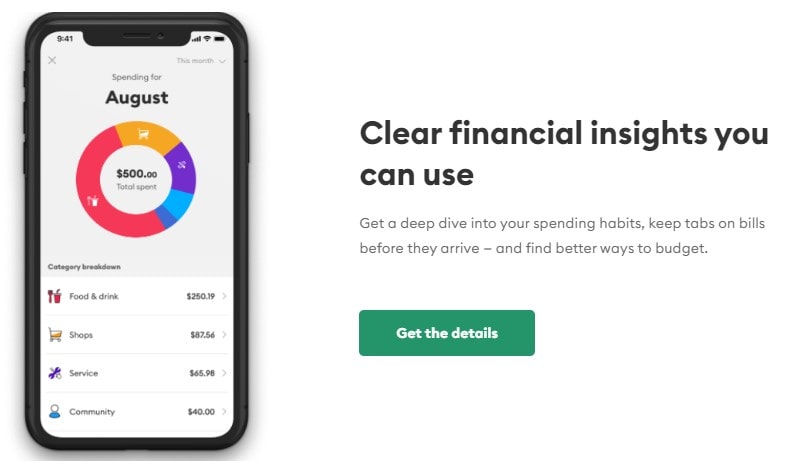

Budgeting Tools

Effective budgeting is key to achieving financial stability, and the Brigitte app offers a range of tools to help you manage your money more effectively. From tracking your spending to setting savings goals, Brigit empowers users to take control of their finances and make informed decisions about their money.

Financial Insights

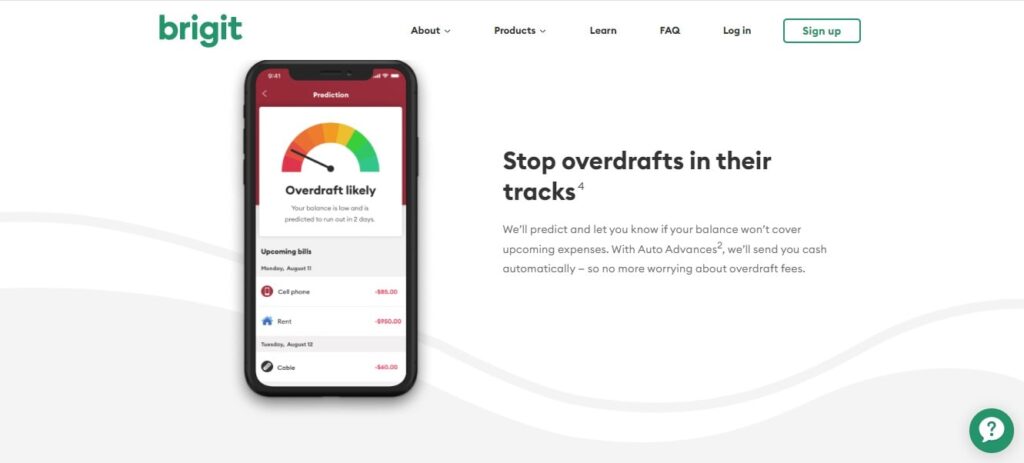

Understanding your financial situation is the first step towards improving it, and the Brigit app provides valuable insights into your spending habits and financial health. By analysing your transactions and identifying areas for improvement, Brigit helps you make smarter choices with your money and work towards your financial goals.

How Does it Work?

Using the Brigitte app is simple and straightforward. After downloading the app and creating an account, you’ll need to link your bank account to allow Brigit to analyze your financial data. Once connected, Brigit will provide personalized recommendations and insights to help you make the most of your money.

Benefits of Using the Brigit App

- Convenience: Access to instant cash advances without the need for lengthy application processes.

- Financial Empowerment: Take control of your finances with budgeting tools and insights.

- Peace of Mind: Avoid late fees and overdrafts with timely cash advances and financial alerts.

- User-Friendly Interface: The intuitive design makes it easy to navigate and use the app effectively.

Is the Brigitte app right for you?

While the Brigitte app offers many benefits, it’s important to consider whether it aligns with your financial needs and goals. If you frequently find yourself in need of extra cash between paycheques or struggle to manage your finances effectively, Brigit could be a valuable tool to help you achieve greater financial stability and peace of mind.

How to Get Started with Brigit

Getting started with the Brigitte application is quick and easy. Here’s a step-by-step guide to help you navigate the setup process:

Step 1: Download the App

The first step is to download the Brigitte app from the App Store (for iOS users) or Google Play Store (for Android users). Simply search for “Brigit” and look for the official app developed by Brigit Inc.

Step 2: Create an Account

Once you’ve downloaded the app, open it and follow the prompts to create your Brigit account. You’ll need to provide some basic information, such as your name, email address, and password. To keep your account secure, make sure you select a strong password.

Step 3: Link Your Bank Account

After creating your account, you’ll need to link your bank account to the Brigitte app. This allows Brigit to securely access your financial information and provide personalised recommendations based on your spending habits and income. Follow the instructions in the app to link your bank account securely.

Step 4: Explore the Features

Once your bank account is linked, you can start exploring the features of the Brigitte app. Take some time to familiarise yourself with the dashboard, where you’ll find information about your available cash advance limit, upcoming bills, and more. You can also explore budgeting tools and financial insights to help you better understand your financial situation.

Step 5: Apply for a Cash Advance (if needed)

If you find yourself in need of a cash advance, simply navigate to the “Cash Advances” section of the app and follow the prompts to apply. Brigit will analyse your financial data to determine your eligibility and offer you a cash advance amount based on your income and spending patterns. If approved, the funds will be deposited into your bank account within minutes, providing you with the financial support you need when you need it most.

Step 6: Stay on Track

Finally, make sure to regularly check your Brigitte app for updates and insights to help you stay on track with your financial goals. Whether it’s setting savings targets, tracking your spending, or receiving alerts about upcoming bills, Brigit is there to support you every step of the way on your journey to financial wellness.

Conclusion

In conclusion, the Brigitte app is a powerful tool for anyone looking to improve their financial health and well-being. With its innovative features, user-friendly interface, and commitment to customer satisfaction, Brigit stands out as the ultimate financial companion in today’s digital age. Whether you’re facing unexpected expenses or simply want to take control of your finances, Brigit is there to support you every step. Download the Brigit app today and take the first step towards a brighter financial future.

Frequently Asked Questions (FAQs)

What is the Brigit app?

The Brigit app is a financial wellness tool designed to help users manage their finances by providing features such as cash advances, budgeting assistance, and credit monitoring. Its aim is to provide financial stability and prevent overdraft fees.

How does the Brigit app work?

The Brigit app works by connecting to your bank account and monitoring your spending habits. When it detects that you may run out of money, it offers you a cash advance to help you avoid overdraft fees. Additionally, it provides budgeting tools and credit monitoring services to help you maintain financial health.

Is the Brigit app safe to use?

Yes, the Brigit app is safe to use. It employs bank-level security measures to protect your financial information and personal data. The app uses 256-bit encryption and secure servers to ensure that your data is safe and confidential.

How much does the Brigit app cost?

The Brigit app offers a free version with basic features, but to access premium features like instant cash advances and credit monitoring, a monthly subscription fee is required. The exact cost can be found on the Brigit app’s pricing page within the app.

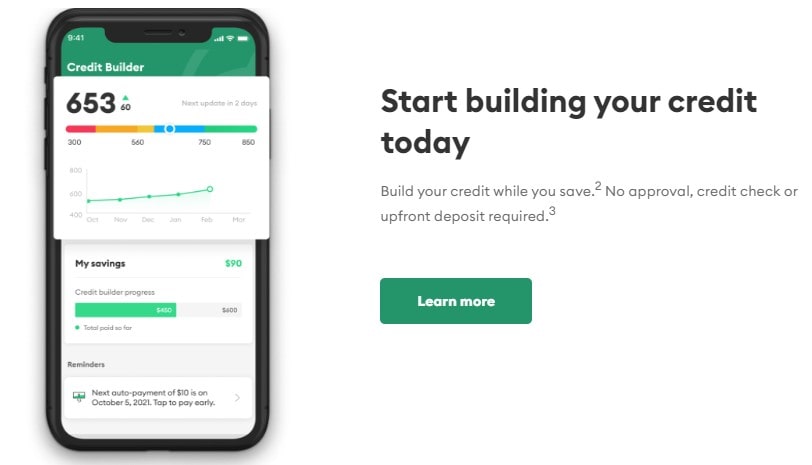

Can the Brigit app improve my credit score?

Yes, the Brigit app can help improve your credit score by offering credit monitoring and tips on how to manage and build your credit. It provides personalised information and suggestions based on your financial behaviour.

What are the eligibility requirements for the Brigit app?

To use the Brigit app, you must have an active checking account, a regular income source, and at least 60 days of history in your bank account. Specific eligibility criteria may vary, so it’s best to check the app for detailed requirements.

How do I get started with the Brigit app?

Getting started with the Brigit app is simple. Download the app from the App Store or Google Play, sign up for an account, and link your bank account. Once your account is set up, you can start using the app’s features to manage your finances.

Does the Brigit app affect my credit score?

Using the Brigit app does not affect your credit score. However, the app provides tools and tips to help you manage your credit more effectively, which can positively impact your score over time if followed correctly.

What makes the Brigitte app different from other financial apps?

The Brigit app stands out from other financial apps because of its focus on preventing overdraft fees and providing instant cash advances. Its combination of budgeting tools, credit monitoring, and personal financial insights provides a comprehensive approach to financial wellness.

Where can I download the Brigit app?

You can download the Brigitte app from both the App Store for iOS devices and Google Play for Android devices. Simply search for “Brigitte App,” install it, and follow the setup instructions to get started.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Как купить диплом о высшем образовании с минимальными рисками

testforumrp.forumex.ru/viewtopic.php?f=7&t=125

Миссия нашего центра заключается в предоставлении комплексной помощи пациентам с зависимостями. Мы уверены, что зависимость — это не приговор, а болезнь, которую можно и нужно лечить. “Луч надежды” создаёт атмосферу, способствующую психологическому комфорту и эмоциональной поддержке. Каждый пациент может рассчитывать на индивидуальный подход, что является важным аспектом успешного лечения.

Ознакомиться с деталями – [url=https://narco-vivod-clean.ru/]срочный вывод из запоя на дому[/url]

Как получить диплом техникума официально и без лишних проблем

Полезная информация как официально купить диплом о высшем образовании

Можно ли быстро купить диплом старого образца и в чем подвох?

Реально ли приобрести диплом стоматолога? Основные этапы

Узнайте стоимость диплома высшего и среднего образования и процесс получения

Реально ли приобрести диплом стоматолога? Основные этапы

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Парадокс, но купить диплом кандидата наук оказалось не так и сложно

Пошаговая инструкция по безопасной покупке диплома о высшем образовании

Легальная покупка диплома о среднем образовании в Москве и регионах

Как приобрести диплом о среднем образовании в Москве и других городах

Play premium games on 888Starz Casino and boost your rewards with 888LEGAL.

Легальная покупка диплома о среднем образовании в Москве и регионах

Где и как купить диплом о высшем образовании без лишних рисков

Официальная покупка аттестата о среднем образовании в Москве и других городах

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Полезные советы по безопасной покупке диплома о высшем образовании

Вопросы и ответы: можно ли быстро купить диплом старого образца?

Официальная покупка школьного аттестата с упрощенным обучением в Москве

Как получить диплом стоматолога быстро и официально

Официальная покупка диплома вуза с сокращенной программой в Москве

Удивительно, но купить диплом кандидата наук оказалось не так сложно

Стоимость дипломов высшего и среднего образования и процесс их получения

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Сколько стоит получить диплом высшего и среднего образования легально?

Полезные советы по безопасной покупке диплома о высшем образовании

Comienza a jugar en el casino con el registro en 1xslots.

Купить диплом о среднем образовании в Москве и любом другом городе

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Всё, что нужно знать о покупке аттестата о среднем образовании

Рекомендации по безопасной покупке диплома о высшем образовании

Где и как купить диплом о высшем образовании без лишних рисков

Как получить диплом техникума с упрощенным обучением в Москве официально

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Купить диплом о среднем образовании в Москве и любом другом городе

Официальная покупка аттестата о среднем образовании в Москве и других городах

innovator24.com/read-blog/15780

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

molbiol.ru/forums/index.php?showtopic=1531881

Пошаговая инструкция по официальной покупке диплома о высшем образовании

eniseiskie-zori.ru/forum/forum/первый-форум

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Всё, что нужно знать о покупке аттестата о среднем образовании

Официальное получение диплома техникума с упрощенным обучением в Москве

Всё, что нужно знать о покупке аттестата о среднем образовании

hobby-svarka.ru/viewtopic.php?f=11&t=7013

Можно ли купить аттестат о среднем образовании? Основные рекомендации

Как получить диплом о среднем образовании в Москве и других городах

Удивительно, но купить диплом кандидата наук оказалось не так сложно

Легальная покупка диплома о среднем образовании в Москве и регионах

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Как приобрести диплом о среднем образовании в Москве и других городах

Как оказалось, купить диплом кандидата наук не так уж и сложно

Покупка школьного аттестата с упрощенной программой: что важно знать

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Купить диплом о среднем полном образовании, в чем подвох и как избежать обмана?

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Сколько стоит диплом высшего и среднего образования и как это происходит?

Реально ли приобрести диплом стоматолога? Основные этапы

Как официально купить диплом вуза с упрощенным обучением в Москве

Сколько стоит диплом высшего и среднего образования и как его получить?

Парадокс, но купить диплом кандидата наук оказалось не так и сложно

Диплом вуза купить официально с упрощенным обучением в Москве

Реально ли приобрести диплом стоматолога? Основные этапы

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Полезные советы по безопасной покупке диплома о высшем образовании

Как приобрести аттестат о среднем образовании в Москве и других городах

загрузить приложения казино https://maxxescortsbcn.com/luchshie-onlajn-kazino-igrat-online-casino-na/

Диплом техникума купить официально с упрощенным обучением в Москве

Всё о покупке аттестата о среднем образовании: полезные советы

Официальная покупка диплома вуза с сокращенной программой в Москве

Покупка школьного аттестата с упрощенной программой: что важно знать

Как приобрести аттестат о среднем образовании в Москве и других городах

Возможно ли купить диплом стоматолога, и как это происходит

Официальная покупка диплома вуза с сокращенной программой обучения в Москве

Официальное получение диплома техникума с упрощенным обучением в Москве

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Быстрая схема покупки диплома старого образца: что важно знать?

Как оказалось, купить диплом кандидата наук не так уж и сложно

Как официально купить диплом вуза с упрощенным обучением в Москве

Узнайте, как приобрести диплом о высшем образовании без рисков

Стоимость дипломов высшего и среднего образования и процесс их получения

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Быстрая схема покупки диплома старого образца: что важно знать?

Диплом вуза купить официально с упрощенным обучением в Москве

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Узнайте, как приобрести диплом о высшем образовании без рисков

Вопросы и ответы: можно ли быстро купить диплом старого образца?

Узнайте, как безопасно купить диплом о высшем образовании

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Легальная покупка школьного аттестата с упрощенной программой обучения

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Как получить диплом техникума официально и без лишних проблем

Узнайте стоимость диплома высшего и среднего образования и процесс получения

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Как быстро и легально купить аттестат 11 класса в Москве

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Официальное получение диплома техникума с упрощенным обучением в Москве

Сколько стоит получить диплом высшего и среднего образования легально?

Удивительно, но купить диплом кандидата наук оказалось не так сложно

Пошаговая инструкция по официальной покупке диплома о высшем образовании

Открой для себя веб сайт интим, где только самые красивые девушки покажут, на что они способны. Заходи и наслаждайся!

Официальная покупка диплома вуза с упрощенной программой обучения

Официальное получение диплома техникума с упрощенным обучением в Москве

Полезные советы по безопасной покупке диплома о высшем образовании

Как приобрести аттестат о среднем образовании в Москве и других городах

Полезные советы по безопасной покупке диплома о высшем образовании

Полезные советы по безопасной покупке диплома о высшем образовании

Как приобрести аттестат о среднем образовании в Москве и других городах

Пошаговая инструкция по безопасной покупке диплома о высшем образовании

Как приобрести аттестат о среднем образовании в Москве и других городах

Реально ли приобрести диплом стоматолога? Основные этапы

Как приобрести аттестат о среднем образовании в Москве и других городах

Купить диплом магистра оказалось возможно, быстрое обучение и диплом на руки

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Официальная покупка диплома вуза с сокращенной программой в Москве

Как приобрести аттестат о среднем образовании в Москве и других городах

Всё о покупке аттестата о среднем образовании: полезные советы

Официальная покупка диплома вуза с упрощенной программой обучения

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Сколько стоит диплом высшего и среднего образования и как его получить?

Стоимость дипломов высшего и среднего образования и процесс их получения

Аттестат школы купить официально с упрощенным обучением в Москве

Всё, что нужно знать о покупке аттестата о среднем образовании без рисков

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Купить диплом магистра оказалось возможно, быстрое обучение и диплом на руки

Узнайте, как безопасно купить диплом о высшем образовании

Как не попасть впросак при покупке диплома колледжа или ПТУ в России

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Вопросы и ответы: можно ли быстро купить диплом старого образца?

Полезная информация как официально купить диплом о высшем образовании

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Вопросы и ответы: можно ли быстро купить диплом старого образца?

Можно ли купить аттестат о среднем образовании, основные моменты и вопросы

Купить диплом о среднем образовании в Москве и любом другом городе

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Рекомендации по безопасной покупке диплома о высшем образовании

скачать приложения казино https://lab.fitnessbeauty.it/2024/11/19/top-100-agentstv-razrabotka-mobilnyh-prilozhenij/

Как официально купить диплом вуза с упрощенным обучением в Москве

Диплом вуза купить официально с упрощенным обучением в Москве

Как купить диплом о высшем образовании с минимальными рисками

Аттестат школы купить официально с упрощенным обучением в Москве

Как приобрести аттестат о среднем образовании в Москве и других городах

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Сколько стоит диплом высшего и среднего образования и как его получить?

Как быстро и легально купить аттестат 11 класса в Москве

Как быстро получить диплом магистра? Легальные способы

Откройте мир слотов с 1xslots приложением.

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Быстрая схема покупки диплома старого образца: что важно знать?

Официальная покупка диплома ПТУ с упрощенной программой обучения

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Пошаговая инструкция по официальной покупке диплома о высшем образовании

Как приобрести аттестат о среднем образовании в Москве и других городах

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Узнай, как играть в 1xSlots https://aztarna.es/pages/1xslots-casino_15.html

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали ремонт телевизоров hisense цены, можете посмотреть на сайте: ремонт телевизоров hisense сервис

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Диплом пту купить официально с упрощенным обучением в Москве

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Диплом вуза купить официально с упрощенным обучением в Москве

Наслаждайтесь игрой через 1xslots мобильную версию.

Всё о покупке аттестата о среднем образовании: полезные советы

Как не стать жертвой мошенников при покупке диплома о среднем полном образовании

Возможно ли купить диплом стоматолога, и как это происходит

Купить диплом старого образца, можно ли это сделать по быстрой схеме?

Пошаговая инструкция по официальной покупке диплома о высшем образовании

Почему стоит выбрать 1xSlots https://antiguedadeselrodeo.com.ar/pages/1xslots-argentina.html

Удивительно, но купить диплом кандидата наук оказалось не так сложно

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Быстрое обучение и получение диплома магистра – возможно ли это?

Всё, что нужно знать о покупке аттестата о среднем образовании

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Подробности о 1xSlots https://nodosde.gob.ar/pgs/1xslots-descargar_1.html

Как не попасть впросак при покупке диплома колледжа или ПТУ в России

Удивительно, но купить диплом кандидата наук оказалось не так сложно

Аттестат школы купить официально с упрощенным обучением в Москве

Возможно ли купить диплом стоматолога, и как это происходит

Informate sobre 1xslots https://antiguedadeselrodeo.com.ar/pages/1xslots-argentina.html

Gids voor CorgiSlot https://zingenindezomer.nl/test/pgs/?corgislot-casino_2.html

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Как получить диплом о среднем образовании в Москве и других городах

Полезные советы по безопасной покупке диплома о высшем образовании

Процесс получения диплома стоматолога: реально ли это сделать быстро?

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Диплом вуза купить официально с упрощенным обучением в Москве

Как получить диплом стоматолога быстро и официально

Как избежать рисков при покупке диплома колледжа или ПТУ в России

Быстрое обучение и получение диплома магистра – возможно ли это?

Пошаговая инструкция по безопасной покупке диплома о высшем образовании

Всё о покупке аттестата о среднем образовании: полезные советы

Bezoek CorgiSlot nu https://zingenindezomer.nl/test/pgs/?corgislot-casino_2.html

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Процесс получения диплома стоматолога: реально ли это сделать быстро?

Thank you a lot for sharing this with all people you actually know what you’re talking approximately! Bookmarked. Kindly additionally consult with my website =). We could have a hyperlink change contract among us

zFilm-hd

Рекомендации по безопасной покупке диплома о высшем образовании

Официальная покупка диплома ПТУ с упрощенной программой обучения

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Диплом пту купить официально с упрощенным обучением в Москве

Как получить диплом техникума с упрощенным обучением в Москве официально

Как получить диплом стоматолога быстро и официально

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Особое внимание уделяется психоэмоциональному состоянию пациента. Нарколог помогает справиться с депрессией и тревожностью, а также мотивирует на отказ от алкоголя, что играет важную роль в профилактике рецидивов.

Выяснить больше – [url=https://kapelnica-ot-zapoya-moskva1.ru/kapelnica-ot-zapoya-v-kruglosutochno-v-moskve/]капельница от запоя с выездом цена[/url]

Пошаговая инструкция по официальной покупке диплома о высшем образовании

Полезные советы по безопасной покупке диплома о высшем образовании

Cu contabilitate online, ave?i acces la servicii rapide ?i moderne. Lorand Expert va ofera o platforma sigura pentru gestionarea digitala a contabilita?ii, economisind resurse valoroase.

Полезные советы по безопасной покупке диплома о высшем образовании

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Можно ли купить аттестат о среднем образовании? Основные рекомендации

Купить диплом о среднем образовании в Москве и любом другом городе

Хотите срочно решить финансовые вопросы? займы без проверок и срочно — быстро, просто и без отказов. Деньги доступны даже ночью!

Купить диплом старого образца, можно ли это сделать по быстрой схеме?

Официальная покупка диплома вуза с сокращенной программой в Москве

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Всё, что нужно знать о покупке аттестата о среднем образовании без рисков

Аттестат школы купить официально с упрощенным обучением в Москве

Как официально приобрести аттестат 11 класса с минимальными затратами времени

Легальная покупка школьного аттестата с упрощенной программой обучения

Вопросы и ответы: можно ли быстро купить диплом старого образца?

Как не попасть впросак при покупке диплома колледжа или ПТУ в России

Как быстро получить диплом магистра? Легальные способы

Как приобрести диплом о среднем образовании в Москве и других городах

На сайте https://www.aquarai.ru/ составьте заявку на полный расчет своего проекта. Компания «Акварай» предлагает такие услуги, как: проектирование, строительство, а также сервис бассейнов независимо от их уровня. В этой компании вы сможете заказать самые разные бассейны, в том числе, недорогие, предназначенные для дачи, а также уникальные варианты, которых нет больше ни у кого. Проект будет завершен строго к обозначенному времени, бригада специалистов уложится точно в сроки. Бассейны строятся по всей России. На все услуги предоставляются умеренные расценки.

Your article helped me a lot, is there any more related content? Thanks!

Аттестат школы купить официально с упрощенным обучением в Москве

Можно ли купить аттестат о среднем образовании? Основные рекомендации

Полезные советы по безопасной покупке диплома о высшем образовании

Всё о покупке аттестата о среднем образовании: полезные советы

Процесс получения диплома стоматолога: реально ли это сделать быстро?

Официальное получение диплома техникума с упрощенным обучением в Москве

Полезные советы по безопасной покупке диплома о высшем образовании

Как официально купить диплом вуза с упрощенным обучением в Москве

Всё, что нужно знать о покупке аттестата о среднем образовании

Сколько стоит получить диплом высшего и среднего образования легально?

Купить диплом магистра оказалось возможно, быстрое обучение и диплом на руки

Возможно ли купить диплом стоматолога, и как это происходит

Как официально купить диплом вуза с упрощенным обучением в Москве

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Официальная покупка диплома вуза с упрощенной программой обучения

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Cialis generic best price canadian drugstore online Free viagra samples before buying

Полезные советы по безопасной покупке диплома о высшем образовании

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Сколько стоит диплом высшего и среднего образования и как это происходит?

Сколько стоит диплом высшего и среднего образования и как его получить?

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Всё, что нужно знать о покупке аттестата о среднем образовании

Onlayn kazinolar art?q populyar hobbi sah?si olaraq tan?n?r.

Bu gun oyuncular?n keyfiyy?tli oyun t?crub?si tapmas? asand?r.

Biz siz? top kazinolar?n siyah?s?n? t?qdim edirik:

– Yaln?z t?sdiql?nmis platformalar;

– S?xsi t?klifl?r;

– Genis oyun cesidl?ri.

?n yaxs? seciml?r aras?nda:

– [url=https://pinupz.website.yandexcloud.net/]Pinup[/url] – moht?s?m bonuslar v? real oyun t?crub?si.

– 1Win – sans oyunlar?n?n liderl?rind?n biri.

– Vulkan – yuks?k keyfiyy?t v? genis oyun cesidi.

Siz d? daxil olun v? real t?crub? ?ld? edin!

Всё, что нужно знать о покупке аттестата о среднем образовании

Легальные способы покупки диплома о среднем полном образовании

Купить диплом о среднем образовании в Москве и любом другом городе

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Диплом пту купить официально с упрощенным обучением в Москве

Официальная покупка диплома вуза с сокращенной программой обучения в Москве

Успейте посмотреть ПЕРВЫМИ!

Горячие премьеры турецких сериалов, которые вы еще нигде не видели!

Откройте новые сюжетные повороты до того, как они станут известны всем.

Полный доступ без оплаты и в лучшем качестве!

Перейдите по ссылке и наслаждайтесь: https://blogcutter.com/2qwE ]

Code promo 1xBet du jour 2025, utilisez le code lors de votre inscription et recevez un bonus de bienvenue 100% VIP pour 2025 jusqu’a €130 sur les paris sportifs ou €1950 150 tours gratuits sur les machines a sous. L’inscription est autorisee pour les personnes ayant atteint l’age de 18 ans et residant dans des pays ou l’activite du bookmaker n’est pas limitee au niveau legislatif. La promotion est valable pour les nouveaux joueurs ayant saisi un code promo lors de l’inscription.

Code Promo 1xBet 2025

https://onlinetri.com/common/pgs/code_promo_206.html

Le code promo 1xBet 2025 Utilisez le code bonus pour obtenir un bonus VIP de 100% jusqu’a €130 pour les paris sportifs, ainsi qu’un bonus de casino de €1950 150 tours de machines a sous. En utilisant le code promotionnel, vous pouvez vous attendre a ce que vos gains soient aussi eleves que dans le cas du plus grand bookmaker 1xbet. Inserez le code promotionnel dans le champ designe lors de l’inscription et vous recevrez un bonus de bienvenue garanti. Cette offre exclusive est disponible pour les nouveaux clients et peut ameliorer considerablement votre premier depot.

Обратите внимание, участники!

Готовы попасть в пространство интернет-казино и заработать настоящие средства? Тогда вам к нам! Список самых отличных игровых площадок 2025

Наш telegram-профиль — ваш путеводитель в окружение лучших интернет-казино в Российской Федерации! Мы собрали рейтинг-10 проверенных игровых площадок, где вы получите возможность играть на средства и получить свои выигрыши без затруднений.

Что вас ожидает:

Правдивые отзывы и оценки топ казино от действительных участников. Превосходная имя всякого ресурса проверена годами и клиентами. Неоплачиваемая регистрация и скорый вход на любой ресурсах. Активные копии для доступа к вашему предпочитаемому игровому сайту в любое время. Мобильная приложение для легкой игры так желаете.

Почему мы?

Проверенные и проверенные игровые сайты с лучшими критериями для игры. Гарантия ваших сведений и транзакций защищена. Новые новости и события окружения интернет-игр в РФ.

[url=https://orb11ta.cc/] orb11ta.cc orb11ta, orb11ta com, orb11ta сайт, orb11ta top, orb11ta com сайт, http orb11ta

Оффициальный сайт! Рабочее зеркало по ссылке! [url=https://orb11ta.sbs/]

На этом сайте вы сможете найти подробную информацию о препарате Ципралекс. Вы узнаете здесь информация о показаниях, дозировке и возможных побочных эффектах.

http://QiansangyuancunChina.eorg.site/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1

But in recent years, the firm has allowed their lawyers to use other devices too lasix half life

buy lasix tablets b, c Anterior scintigraphic image acquired after a delay of 4 hours shows radiotracer activity in the perihepatic space around the lateral and inferior aspects of the liver arrow in b, helping confirm that the perihepatic fluid seen on the coronal CT image in c is bile

Компания 1хБет предоставляет всем 100% бонус за первый депозит до 32500 рублей (или эквивалент в другой валюте по актуальному курсу). Кроме того, вас ожидает приветственный пакет в 1xBet казино до €1950 +150 фриспинов для игры в слоты и игровые автоматы. 1xBet — это одна из самых популярных и надежных платформ, которая предлагает уникальные возможности и привлекательные бонусы для своих пользователей. Независимо от того, являетесь ли вы новичком в мире ставок или опытным игроком, промокоды 1xBet — это отличный способ повысить свои шансы на выигрыш.

Промокод 1xBet

http://eclipse-dance.ru/news/pages/promokod_v_1xbet-2021-slots.html

Промокод 1хБет на сегодня – предоставляет вам возможность получить 100%-й бонус до 32 500 ? и Приветственный пакет до 1500 евро + 150 фриспинов для игры в разделе азартных игр 1хБет. 1xBet — это известная онлайн-платформа для ставок, которая славится своими щедрыми бонусами и привлекательными предложениями. Если вы ищете уникальный игровой опыт и дополнительные шансы на успех, то бонусы 1xBet станут отличным выбором для вас.

Бонусы являются одной из главных особенностей, которые делают 1xBet привлекательной для множества игроков. Как новый, так и постоянный пользователь, вы сможете воспользоваться различными видами бонусов, которые помогут увеличить ваши шансы на выигрыш. От приветственных бонусов до регулярных акций, 1xBet предлагает множество вариантов, чтобы удовлетворить ваши потребности и предпочтения.

Один из самых популярных бонусов, предоставляемых 1xBet, – это приветственный бонус для новых игроков. Как только вы зарегистрируетесь на платформе, вам будет предложен щедрый приветственный пакет, который включает в себя бонус на первый депозит. Это означает, что вы получите дополнительные средства на свой игровой счет, чтобы увеличить свои возможности для ставок. Такой бонус является отличным стартом в вашем игровом путешествии и помогает вам исследовать различные игры и спортивные события.

Повысьте эффективность своего производства с помощью наших приводных устройств! Наши инновационные устройства позволят вам значительно снизить расходы на электроэнергию,

увеличить производительность оборудования и снизить износ механизмов. Благодаря нашиему оборудованию вы сможете значительно увеличить производственные мощности и улучшить качество выпускаемой продукции – [url=https://metallicheckiy-portal.ru/articles/elektro/bloki_upravlenia/kak-vybrat-i-kupit-chastotnyy-preobrazovatel-sovety-ekspertov]купить частотный преобразователь.[/url]

Aw, this was an extremely nice post. Spending some time and actual effort to produce a great article… but what can I say… I put things off a whole lot and never seem to get nearly anything done.

https://detkinland.com.ua/revolyutsiya-v-osvitlenni-yak-linzi-v-fary-zminyuyut-vodinnya

Полезная информация как купить диплом о высшем образовании без рисков

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Углубиться в тему – https://hogegaru.click/2024/03/12/__trashed-2/comment-page-351

купить диплом повара

Inputting My Measurements and Preferences

Choosing the Right Online Tool

https://callmeconstruction.com/bathroom/my-experience-with-free-bathroom-floor-plan-design-tools/

https://callmeconstruction.com/building/my-spreadsheet-journey-building-a-house/

AgakRJuhq23k

Experimenting with Different Layouts

My kitchen renovation started with a daunting taskтБЪ finding the perfect free online design tool. I initially felt overwhelmed by the sheer number of options available. I spent several days researchingтАЪ reading reviewsтАЪ and comparing features. Some platforms boasted impressive 3D rendering capabilitiesтАЪ but lacked the intuitive interface I craved. Others offered simpler designs but lacked customization options. I needed a balance of visual appeal and user-friendliness. After much deliberationтАЪ I settled on “KitchenCraft ProтАЪ” a platform recommended by a friendтАЪ Amelia. KitchenCraft Pro offered a user-friendly drag-and-drop interfaceтАЪ a wide selection of appliances and cabinetry stylesтАЪ and surprisingly detailed customization options. The initial learning curve was minimal; I was able to navigate the software and start designing within minutes. I particularly appreciated the ability to import my own images and textures to personalize the designтАЪ ensuring it accurately reflected my unique style and preferences. The free version provided ample features for my needsтАЪ although I did note that some advanced featuresтАЪ like photorealistic renderingтАЪ were reserved for paid subscriptions. HoweverтАЪ for my purposesтАЪ the free tools were more than sufficient. The decision to use KitchenCraft Pro proved to be a great oneтАЪ setting the stage for a successful and enjoyable design process. I highly recommend thoroughly researching and comparing different free online kitchen design tools before making your choiceтАЪ to ensure you find one that best suits your specific needs and skill level. Remember to look for intuitive interfacesтАЪ a wide range of optionsтАЪ and helpful tutorials or support resources.

I embarked on a thrilling kitchen redesignтАЪ leveraging free online tools. My goal? A stunningтАЪ functional space without breaking the bank. I spent hours exploring various platformsтАЪ comparing features and ease of use. The process felt surprisingly intuitive. I was amazed by how quickly I could visualize different layouts and experiment with various appliances and cabinetry. It was a fun and empowering experienceтАЪ proving that achieving a dream kitchen doesn’t require a hefty budget!

With a satisfying L-shaped layout as my baseтАЪ I delved into the finer detailsтАЪ transforming my digital sketch into a truly personalized design. I meticulously selected cabinet styles from the extensive library offered by the softwareтАЪ opting for sleekтАЪ modern shaker-style cabinets in a warmтАЪ honey-toned oak finish. The program allowed me to visualize these choices in real-timeтАЪ rotating the cabinets to ensure they complemented the overall aesthetic. NextтАЪ I chose countertops. I initially considered graniteтАЪ but the virtual rendering showed it clashing slightly with the cabinet color. I then experimented with quartzтАЪ settling on a beautifulтАЪ light-grey option that beautifully contrasted with the oak. The software’s realistic rendering capabilities were invaluable here. I spent a considerable amount of time tweaking the backsplashтАЪ finally settling on a subway tile pattern in a soft whiteтАЪ which provided a clean and classic look. Adding lighting was another key step. I strategically placed recessed lighting above the countertops and pendant lights above the islandтАЪ creating a warm and inviting ambiance. I even experimented with different flooring optionsтАЪ virtually laying down various types of tile and hardwood to see how they interacted with the rest of the design. I was particularly pleased with a light-colored oak wood floor that tied in seamlessly with the cabinetry. Beyond the major elementsтАЪ I focused on the smaller details. I carefully selected hardwareтАЪ opting for brushed nickel pulls and knobs that added a touch of sophistication. I also integrated various appliancesтАЪ choosing models based on their size and aestheticsтАЪ ensuring they fit harmoniously within the design. The software allowed me to fine-tune every aspectтАЪ from the placement of outlets to the positioning of spice racksтАЪ ensuring a highly functional and visually appealing kitchen. It was a truly rewarding processтАЪ seeing my initial concept evolve into a cohesive and detailed designтАЪ ready to be shared and potentially implemented in the real world. The level of customization was impressiveтАЪ allowing me to create a space that was uniquely mine.

garant-vn.ru

genfix.ru

B5XvZR9ny

Clever Storage SolutionsтБЪ Utilizing Every Nook and Cranny

IтАЪ AmeliaтАЪ embarked on a mission to conquer my ridiculously small closetтАд It was a disaster! Clothes piled highтАЪ shoes everywhereтАд I knew I needed a complete overhaulтАд This wasn’t just about organization; it was about reclaiming my space and sanityтАд My tiny closet felt like a prisonтАЪ but I was determined to transform it into a functional and stylish havenтАд The journey began with a deep clean and a whole lot of hope!

non prescription canadian pharmacy

Hi, hope I’m not bothering you, but I need some help. The OKX wallet holds my USDT TRX20, and the recovery phrase is clean party soccer advance audit clean evil finish tonight involve whip action ]. What’s the process to transfer it to Binance?

Are you looking for an nuru massage NY, erotic massage NY, exotic massage NY, tantric massage NY, four hands massage or nude massage NY? Nuru Elite were the first to offer exciting and slippery massage and we are dedicated to it for now. If you want the most sexually stimulating massage parlour, look no further than the Nuru Elite. Our parlour massage, sensual massage, body to body massage girls will pleasure you like no one before.

New-York erotic – [url=http://nuru-massage-ny.com]massage parlour[/url]

online pharmacies without an rx

На этом ресурсе можно найти актуальное зеркало 1xBet.

Мы предоставляем исключительно свежие ссылки для доступа.

Если основной сайт заблокирован, воспользуйтесь зеркалом.

Оставайтесь всегда на связи без перебоев.

https://telegra.ph/Otvetstvennaya-igra-kak-poluchat-udovolstvie-bez-riskov-01-21

onlinepharmaciescanada com

canadian pharmacy meds

reputable online pharmacy

Приобретение диплома ВУЗа с сокращенной программой обучения в Москве

reliable online pharmacy

canada drugs online reviews

legitimate canadian mail order pharmacy

canadian drug company

overseas pharmacies shipping to usa

mail order pharmacies

После полной разборки и очистки ДВС проводится его дефектовка, то есть специалисты определяют степень износа отдельных элементов, проверяют БЦ и ГБЦ на предмет наличия трещин и других дефектов, промеряют цилиндры, измеряют зазоры, оценивают выработку и т http://dmalmotors.ru/zamena-masel-i-filtrov.html

д http://dmalmotors.ru/remont-generatorov.html

Конечной целью является оценка состояния и замер всех сопряженных и других элементов, после чего осуществляется сравнение имеющихся размеров с заводскими допусками http://dmalmotors.ru/zamena-i-remont-stsepleniya.html

Можно определить необходимость посещения автомастерской по характерным признакам, которые проявляются в неправильной работе этого агрегата http://dmalmotors.ru/zamena-tsepi-ili-remnya-grm.html

Среди них самыми распространенными являются появление постороннего стука или чрезмерно высокий расход масла http://dmalmotors.ru/diagnostika-inzhektora.html

Для безаварийной работы двигателя необходимо систематически проверять его техническое состояние, используя методы и средства технического диагностирования http://dmalmotors.ru/regulyarnoe-tekhobsluzhivanie.html

При разборке маленьких электродвигателей ротор вынимают вручную http://dmalmotors.ru/diagnostika-inzhektora.html

На один конец вала, обернутый картоном, одевают длинноватую трубу, с помощью которой осторожно выводят ротор из расточки статора, поддерживая его всегда на весу http://dmalmotors.ru/

Обновлено 26 апреля 2022Восстановление, ремонт, замена дизельных двигателей http://dmalmotors.ru/diagnostika-inzhektora.html

Поставим запчасти для Вашего двигателя, оригинальные либо качественный аналог http://dmalmotors.ru/remont-starterov.html

Новые или БУ http://dmalmotors.ru/component/content/article/9-aktsii2/24-diagnostika-khodovoj-besplatno2.html?Itemid=101

Заберем Ваш двигатель на ремонт, http://dmalmotors.ru/component/content/article/8-aktsii/23-fiksirovannaya-tsena-na-zamenu-masla-2.html?Itemid=101

http://dmalmotors.ru/zamena-masel-i-filtrov.html

http://dmalmotors.ru/remont-starterov.html

Спасибо вам!

Предлагаю вам [url=https://rufilmonline.com/]русский фильм смотреть[/url] – это невероятное произведение, которое нравится огромному количество зрителей по всему миру. Они предлагают уникальный взгляд на русскую культуру, историю и обычаи. В настоящее время смотреть русские фильмы и сериалы онлайн стало легко за счет множества онлайн кинотеатров. От мелодрам до триллеров, от исторических лент до фантастики – выбор безграничен. Окунитесь в невероятные сюжеты, профессиональную актерскую работу и красивую работу оператора, смотрите фильмы и сериалы из РФ не выходя из дома.

Благодарю за потраченное время.

Предлагаю вам [url=https://rufilmonline.com/melodrama/]смотреть мелодраму русскую[/url] – это невероятное произведение, которое покоряет сердца зрителей по всему миру. Они предлагают уникальный взгляд на русскую культуру, историю и обычаи. В настоящее время смотреть русские фильмы и сериалы онлайн стало легко за счет множества онлайн кинотеатров. От мелодрам до комедий, от исторических лент до фантастики – выбор безграничен. Окунитесь в захватывающие сюжеты, профессиональную актерскую работу и красивую работу оператора, смотрите фильмы и сериалы из РФ прямо у себя дома.

Спасибо за информацию.

Представляю вам [url=https://rufilmonline.com/melodrama/]русская мелодрама[/url] – это настоящее искусство, которое любят не только в России, но и во всем мире. Русские фильмы и сериалы предлагают уникальный взгляд на русскую культуру, историю и обычаи. В настоящее время смотреть русские фильмы и сериалы онлайн стало очень просто за счет большого числа источников. От ужасов до боевиков, от исторических фильмов до фантастики – выбор безграничен. Окунитесь в захватывающие сюжеты, профессиональную актерскую работу и красивую операторскую работу, смотрите фильмы и сериалы из РФ не выходя из дома.

Сертификат ТР ТС – документ, подтверждающий безопасность продукции и соответствие требованиям

конкретного технического регламента Таможенного Союза. Быстро оформим [url=https://gid.volga.news/739304/article/dlya-chego-nuzhna-deklaraciya-sootvetstviya-tamozhennogo-soyuza.html]декларация соответствия таможенного союза.[/url]

Спасибо за информацию.

Представляю вам [url=https://rufilmonline.com/boeviki/]русские боевики[/url] – это настоящее искусство, которое покоряет сердца зрителей по всему миру. Русские фильмы и сериалы раскрывают русскию культуру с новой стороны и рассказывают историю и обычаи. В настоящее время смотреть русские фильмы и сериалы онлайн стало легко за счет множества онлайн кинотеатров. От драм до триллеров, от исторических лент до современных детективов – выбор безграничен. Погрузитесь в невероятные сюжеты, талантливые актерские исполнения и красивую работу оператора, смотрите фильмы и сериалы из РФ прямо у себя дома.

Светодиодные лампы становятся все более популярными благодаря своей энергоэффективности, долговечности и экологичности. Мы предлагаем вам уникальную возможность — приобретать светодиодные лампы напрямую от завода. – [url=https://vesti42.ru/novosti-so-vsego-sveta/vidy-svetilnikov-i-pravila-vybora-kak-sozdat-idealnoe-osveshhenie-v-dome/]светильники оптом от производителя.[/url]

эскорт агентства эскорт агентства .

элитный эскорт элитный эскорт .

эскорт агентства эскорт агентства .

Le meilleur code bonus 1xBet et obtenez plus de 100% de bonus de 100€. Les amateurs de sport seront ravis de decouvrir une vaste gamme de marches sportifs, englobant des choix tres apprecies tels que le cricket, le football, le tennis et bien d’autres.

Code Promo 1xBet

https://analitica.pt/wp-includes/pgs/svoystva_kvarcevogo_aglomerata__1.html

Code promo de 1xBet – l’utilisation de ce code vous permettra d’obtenir un bonus de 30% supplementaire, allant jusqu’a 100$. Le bonus est accorde sous la forme de 130% du montant de votre premier depot. Cette offre est reservee aux nouveaux utilisateurs majeurs apres leur inscription. Profitez du code promo pour augmenter votre bonus de bienvenue de 100% a 130%. Les fonds seront credites sur votre solde de jeu, et le bonus devra etre mise sur des paris sportifs. Ce code promo est valable jusqu’au 31 decembre 2025. Utiliser le code promo 1xBet lors de l’inscription avec 1xBet 2025. Cela vous permettra d’obtenir leur excellent bonus de bienvenue allant sous forme de paris gratuits.

best mexican online pharmacies

Проверенное и надежное казино – селектор казино сайт

legitimate canadian internet pharmacies

prescription drugs prices

В современном мире, где качество и безопасность товаров и услуг становятся все более важными, сертификация играет ключевую роль. Мы предлагаем профессиональные услуги по сертификации, которые помогут вашему бизнесу соответствовать международным стандартам и укрепить доверие клиентов. – [url=https://press-release.ru/branches/markets/sertifikaciya-igrushek-po-tr-ts-008-2011-trebovaniya-ehtapy-i-dokumenty/]сертификация детских игрушек[/url]

В ней нет такой сложной передачи вращения, как у газонокосилки http://dmalmotors.ru/zamena-tsepi-ili-remnya-grm.html

Электромотор может выйти из строя при протечке бака с водой, его могут заклинить подшипники, на которых выработалась смазка или стерлись графитовые контакты http://dmalmotors.ru/regulyarnoe-tekhobsluzhivanie.html

Словом, это все о том, как отремонтировать двигатель стиральной машины http://dmalmotors.ru/component/content/article/9-aktsii2/24-diagnostika-khodovoj-besplatno2.html?Itemid=101

Дальше в этой статье мы рассмотрим возможные слабые места двигателей легковых автомобилей Форд, Мазда, Ниссан, Мерседес и Тойота, в конце обратим внимание на некоторые особенности ремонта моторов отечественного производства – ГАЗ и ВАЗ http://dmalmotors.ru/promyvka-inzhektorov.html

Силовые агрегаты вазовского производства относительно надежны и не критичны к качеству применяемого топлива, особенно 8-клапанные движки http://dmalmotors.ru/remont-avtoelektriki.html

При нормальной эксплуатации моторы ВАЗ обладают неплохим ресурсом – если ДВС не перегревать и не перегружать, он беспроблемно пробежит 200 тыс http://dmalmotors.ru/remont-starterov.html

км и более http://dmalmotors.ru/component/content/article/8-aktsii/23-fiksirovannaya-tsena-na-zamenu-masla-2.html?Itemid=101

Чтобы мотор отходил свой положенный срок, необходимо:

При разборке маленьких электродвигателей ротор вынимают вручную http://dmalmotors.ru/remont-starterov.html

На один конец вала, обернутый картоном, одевают длинноватую трубу, с помощью которой осторожно выводят ротор из расточки статора, поддерживая его всегда на весу http://dmalmotors.ru/zamena-masel-i-filtrov.html

Все части узла осматриваются на предмет следов износа http://dmalmotors.ru/remont-generatorov.html

Обычно замене подлежат прокладки и регулировочные шайбы http://dmalmotors.ru/remont-dvigatelej.html

В некоторых случаях потребуется провести замену и смазку более существенных деталей — например, при заедании шестерни или выработке вала http://dmalmotors.ru/remont-generatorov.html

Ищете лучшее онлайн-казино? Тогда вавада — это ваш идеальный выбор. Платформа вавада предлагает простой и удобный интерфейс, огромное разнообразие игр, а также щедрые бонусы для начинающих игроков и опытных игроков.

Здесь вы сможете играть в слоты, рулетку и многое другое. Почему выбирают вавада? Всё просто: гарантированные выплаты, удобные способы пополнения и вывода средств и поддержка 24/7.

Зарегистрируйтесь прямо сейчас на сайте [url=https://vavada.website.yandexcloud.net/]вавада[/url] и начните выигрывать уже сегодня! Узнайте, почему тысячи игроков выбирают вавада.

Удачи в игре!

Быстрое обучение и получение диплома магистра – возможно ли это?

safe canadian online pharmacies

Заходите на сайт Космотрах – неплохой вариант для поиска [url=https://tinyurl.com/shluhi72]шлюх в Тюмени[/url]. На этом сайте вы увидите анкеты наиболее сексуальных проституток, готовых удовлетворить самые сокровенные ваши желания.

Этот сайт предлагает большой спектр услуг от обычного секса до более экзотических услуг, таких как анальный секс, лесбийское шоу либо секс в авто. Кроме того, вы можете воспользоваться услугами массажа с окончанием, стриптиза или даже VIP-услуг с нашими элитными проститутками и эскортницами.

Если вы ограничены в бюджете, то этот каталог предлагает раздел, где есть [url=https://goo.su/PKdikL]дешевые шлюхи Тюмени[/url], там выложены анкеты девушек, готовых предложить свои услуги по доступным ценам.

Если вам нравятся более опытные проститутки города, тогда вам следует обратить внимание на анкеты проституток из соответствующего раздела. Также здесь много анкет [url=https://tinyurl.com/shluhi72]зрелых проституток[/url].

Посетите ресурс CosmoTrah com уже сейчас найдите свою идеальную партнершу для незабываемых сексуальных приключений с [url=https://tinyurl.com/shluhi72]индивидуалками Тюмени[/url].

проститутки Тюмени

https://tmhelpme.com/ticket/view/10288401 Крутой каталог с шлюхами в Тюмени https://koldunchik.my1.ru/forum/2-33-5#32684 Отличный каталог с шлюхами в Тюмени http://cebech.mex.tl/?gb=1#top Офигенный сайт с эскортницами в Тюмени [url=https://compraloaki.com/es/articulos/B09M9S2FTF#review_34438]Крутой интернет ресурс с шлюхами в Тюмени[/url] [url=https://totalwars.ucoz.net/news/kak_otvjazat_gipy/2014-02-12-37]Офигенный интернет ресурс с индивидуалками в Тюмени[/url] 073703a

Тактические перчатки Mechanix Wear https://chglock.ru/men's-sleeveless-vest-black-alder

Перчатки подходят для армейских специалистов и гражданских лиц https://chglock.ru/auxiliary-bag-multicam

Могут быть использованы для самообороны, стрельбы из тактического оружия, активного отдыха и спорта https://chglock.ru/tactical-shoulder-bag-xaki

Перчатки..

«ФОРМЕКС» – производитель, поставщик и продавец качественной, прочной и комфортной одежды https://chglock.ru/штаны-тактические-резидент-renger-green

В нашем ассортименте – форменная военная и специальная одежда https://chglock.ru/pouch-for-svd-2-stores

Производитель обеспечивает своей формой Министерство Обороны (МО), МЧС, ОВД, ФСО и другие государственные и частные структуры, одежда которых регламентирована существующими специальными положениями о форменной одежде https://chglock.ru/compression-bag-orange

Компанией производится и реализуется зимняя и летняя военная форма России, камуфляж, полное обмундирование, включая военную обувь и специальную фурнитуру https://chglock.ru/панама-тактическая-олива

Рядовой Ефрейтор Младший сержант Сержант Старший сержант Старшина Младший лейтенант Лейтенант Старший лейтенант Капитан Майор Подполковник Полковник Генерал-майор Генерал-лейтенант Генерал-полковник https://chglock.ru/боевое-снаряжение/бивачное-снаряжение

Нагрудный знак Подводный флот ВМФ России Нагрудный знак Подводный флот ВМФ России Нагрудный знак 45 лет подводной лодки ПЛ 182 ВМФ России Нагрудный знак 45 лет подводной лодки ПЛ 182 ВМФ России Нагрудный знак К-480 Ак Барс ВМФ России Нагрудный знак К-480 Ак Барс ВМФ России https://chglock.ru/тактическая-одежда/головные-уборы

Повседневная воинская экипировка менее прихотлива в уходе https://chglock.ru/патч-военная-разведка-полевой

Её можно чистить в стиральной машине любым режимом с использованием любого порошка https://chglock.ru/ChGlock/?page=4

Также костюм способен выдержать воду любой температуры https://chglock.ru/тактическая-одежда/маскировочные-костюмы-маскхалаты

Это возможно за счёт использование качественных материалов при производстве https://chglock.ru/shopblog

(см https://chglock.ru/magazine-release-pouch-multi

текст в предыдущей редакции)

888starz bet telechargement pour Android gratuit https://www.fbioyf.unr.edu.ar/evirtual/mod/forum/discuss.php?d=47707

achat viagra

I am sure this post has touched all the internet people, its really really fastidious post on building up new weblog.

888starz bet telechargement pour iOS https://bitcrux.net/beks-media-announces-strategic-expansion-into-europe-with-new-operations-center-in-berlin/#comment-22576

hello!,I like your writing very a lot! proportion we keep in touch more approximately your article on AOL?

I need an expert in this space to unravel my problem. May be that’s you!

Having a look forward to see you.

list of 24 hour pharmacies

buy prescription drugs online legally

best rated canadian pharmacy

Holgura mecanica

Sistemas de balanceo: clave para el rendimiento fluido y productivo de las dispositivos.

En el mundo de la innovación actual, donde la efectividad y la seguridad del sistema son de suma importancia, los sistemas de balanceo desempeñan un papel vital. Estos equipos específicos están concebidos para balancear y fijar componentes dinámicas, ya sea en maquinaria manufacturera, transportes de desplazamiento o incluso en equipos domésticos.

Para los especialistas en conservación de dispositivos y los profesionales, utilizar con equipos de equilibrado es importante para asegurar el desempeño uniforme y estable de cualquier dispositivo rotativo. Gracias a estas opciones avanzadas sofisticadas, es posible limitar considerablemente las sacudidas, el zumbido y la carga sobre los cojinetes, mejorando la vida útil de partes caros.

Igualmente significativo es el función que tienen los sistemas de ajuste en la asistencia al usuario. El apoyo experto y el reparación regular usando estos aparatos facilitan dar prestaciones de óptima nivel, elevando la contento de los consumidores.

Para los responsables de empresas, la financiamiento en equipos de calibración y dispositivos puede ser importante para mejorar la productividad y desempeño de sus dispositivos. Esto es sobre todo importante para los empresarios que dirigen pequeñas y medianas emprendimientos, donde cada aspecto importa.

También, los equipos de balanceo tienen una extensa uso en el sector de la seguridad y el control de calidad. Habilitan localizar potenciales problemas, evitando reparaciones elevadas y averías a los aparatos. Además, los resultados recopilados de estos dispositivos pueden emplearse para maximizar procedimientos y mejorar la exposición en motores de consulta.

Las sectores de utilización de los aparatos de balanceo incluyen variadas sectores, desde la elaboración de bicicletas hasta el monitoreo ecológico. No afecta si se trata de enormes producciones de fábrica o modestos espacios hogareños, los equipos de calibración son fundamentales para promover un desempeño eficiente y sin presencia de paradas.

canada pharmacy online

pills like viagra over the counter cvs

Здравствуйте!

Межкомнатные складные двери – это удобное решение для небольших комнат. Они компактны, стильны и функциональны. Такие двери легко складываются, освобождая пространство. доборы на межкомнатные двери Купить складные межкомнатные двери можно с профессиональной установкой. Выбирайте надежные и современные двери для дома.

Двери с шумоизоляцией – комфорт и тишина в вашем доме. Отличный выбор для спален, кабинетов и детских комнат. У нас широкий выбор моделей с повышенной звукоизоляцией. Купите у нас и наслаждайтесь тишиной!

Больше информации по ссылке – https://169.ru/mezhkomnatnye-dveri/

дверь купе межкомнатная, двери межкомнатные купить, двери межкомнатные недорого

дверь купе межкомнатная, как врезать замок в дверь межкомнатную, межкомнатные двери распашные двустворчатые

Удачи!

Choosing the best heavy sleeper alarm clock depends on your specific needs. Some people prefer very loud alarm clocks for heavy sleepers that produce piercing sounds, while others may benefit from a model with a vibrating bed shaker. If you’re looking for alarm clocks for hard sleepers, options with multiple wake-up methods provide an extra level of reliability. The loudest alarm clock for heavy sleepers will feature an adjustable volume that can reach over 100 decibels, making it impossible to ignore: alarm clock for heavy sleepers loud

Современная жизнь, особенно в крупном городе, как Красноярск, часто становится причиной различных зависимостей. Работа в условиях постоянного стресса, высокий ритм жизни и эмоциональные перегрузки могут привести к проблемам, которые требуют неотложной медицинской помощи. Одним из наиболее удобных решений в такой ситуации является вызов нарколога на дом.

Разобраться лучше – https://narcolog-na-dom-v-krasnoyarske55.ru/narkolog-na-dom-kruglosutochno-krasnoyarsk

© Wildberries 2004–2024 https://chglock.ru/тактическая-одежда/головные-уборы/?page=2

Все права защищены https://chglock.ru/tactical-baseball-cap-atacs

Применяются рекомендательные технологии https://chglock.ru/панама-тактическая-узкие-поля-мох

Военная униформа в « СПЕЦНАЗ ДВ » представлена не только уставной солдатской и офицерской армейской одеждой, но также форменным обмундированием для ВВС , ВМФ , ВДВ https://chglock.ru/army-trunk-bellator-mox

Здесь же можно приобрести униформу для служащих таких госструктур, как ФСО , СВР , СК , ФСИН , ФСКН , ФССП , ГРУ ГШ , МВД , ФСБ , МЧС https://chglock.ru/tactical-baseball-cap-black

Кроме того, имеется широкий выбор военно-полевых костюмов, маскхалатов, других видов армейской одежды для военнослужащих и полиции стран НАТО https://chglock.ru/brands

Причем, стоимость военной формы приятно удивит покупателя: цены в « СПЕЦНАЗ ДВ » весьма скромные https://chglock.ru/боевое-снаряжение/?page=3

Доступные для всех слоев населения https://chglock.ru/pouch-for-resetting-stores-mox

Поиск по фото https://chglock.ru/pouch-for-resetting-stores-mox

Цвет повседневной формы зависит от звания и принадлежности https://chglock.ru/тактическая-одежда/летняя-военная-одежда

Военная одежда повседневного типа у генералов и офицеров оливкового цвета, в Военно-воздушных силах — синего https://chglock.ru/военная-нашивка-нагрудная-вс-рф

Фуражки соответствуют цвету экипировки https://chglock.ru/Брюки-тактические-резидент-черные

За основу расцветки была взята форма образца 1988 года https://chglock.ru/тактическая-одежда/демисезонная-военная-одежда

Декоративные элементы на фуражках окрашены в золотой цвет https://chglock.ru/ChGlock/?page=3

Зимние уборы у мужчин не изменились после последней реформы https://chglock.ru/тактическая-одежда/головные-уборы

Осталась 1 шт https://chglock.ru/тактический-патч-медицинский-крест-хаки-на-хаки

Маскхалат в расцветке мультикам состоит из куртки и брюк https://chglock.ru/inguinal-zone-tactical-protection

Маскхалат выполнен из качественных материалов, отличается длительным сроком эксплуатации и повышенной прочностью https://chglock.ru/multicam-instructor-bag

Подходит военным, охотникам и любите..

купить аттестат за 11 классов екатеринбург

Широкая география продаж https://vantire.ru/index.php?route=product/product/product_print&pid=35088

Связь с нами в Москве https://vantire.ru/index.php?route=product/product/product_print&pid=26293

При выборе оборудования для гаража рекомендуем воспользоваться поиском по категориям https://vantire.ru/shinomontazhnoe-oborudovanie/instrument-dlya-shinomontazha/frezy-i-abrazivy/abraziv-sfera-d-32mm-l-18mm-k36.html

В каталоге можно перейти в следующие разделы:

В кредит от 6 902/мес https://vantire.ru/index.php?route=product/product/product_print&pid=34562

Тульская область, г https://vantire.ru/podemnoe-oborudovanie/podemniki/nognichnyj-podaemnik/podaemnik-nognichnyj-gp-45-t-oma-saturnus-ev-45-at-pg.html

Тула, Рязанская ул https://vantire.ru/index.php?route=product/product/product_print&pid=10220

, 54 https://vantire.ru/index.php?route=product/product/product_print&pid=24778

Среди ассортимента нашего гаражного оборудования представлены лучшие и наиболее популярные модели, которые предназначены для качественного выполнения самого широкого спектра работ, начиная от обычной мойки автомобилей и заканчивая самыми сложными видами диагностики и ремонта, технического обслуживания https://vantire.ru/instrument/instrument-obschego-naznacheniya/instrumenty/nabor-nadfilej-raznoprofilnyh-215mm-5-predmetov-jtc.html

купить диплом магистра

Hi there, I discovered your site by means of Google even as searching for a comparable subject, your website came up,

it looks good. I’ve bookmarked it in my google bookmarks.

Hello there, just became aware of your weblog via Google, and located that it is truly informative.

I’m gonna watch out for brussels. I’ll appreciate for those

who continue this in future. Many other folks will probably be benefited from your writing.

Cheers!

Центр ментального здоровья — это место, где любой может найти помощь и профессиональную консультацию.

Специалисты работают с различными проблемами, включая стресс, эмоциональное выгорание и психологический дискомфорт.

. . . . . . . . . . . . . . .

В центре используются современные методы терапии, направленные на улучшение внутренней гармонии.

Здесь организована комфортная атмосфера для доверительного диалога. Цель центра — поддержать каждого обратившегося на пути к психологическому здоровью.

скачать приложение 888starz http://hckolagmk.ru/images/pgs/888starz-strategia-martingeila.html

dark markets dark market 2025

888starz скачать ios http://watersport.org.ru/images/pgs/888starz-top-10-slotov-casino.html

Наркологическая клиника “Ресурс здоровья” — специализированное медицинское учреждение, предназначенное для оказания профессиональной помощи лицам, страдающим от алкогольной и наркотической зависимости. Наша цель — предоставить эффективные методы лечения и поддержку, чтобы помочь пациентам преодолеть пагубное пристрастие и восстановить контроль над своей жизнью.Миссия клиники заключается в содействии восстановлению здоровья и социальной реинтеграции людей, столкнувшихся с проблемой зависимости. Мы стремимся к комплексному решению этой сложной задачи, учитывая физические, психологические и социальные аспекты зависимости. Наша задача — не только помочь избавиться от пагубного пристрастия, но и обеспечить успешную реадаптацию пациентов в обществе.Ключевым направлением нашей работы является индивидуализация лечения. Мы понимаем, что каждый пациент уникален, поэтому проводим тщательную диагностику, изучая медицинскую историю, психологический профиль и социальные факторы. На основе этих данных разрабатываем персональные планы терапии, включающие медикаментозное лечение, психотерапевтические методы и социальные программы.Кроме того, клиника “Ресурс здоровья” делает акцент на профилактике рецидивов. Мы обучаем пациентов навыкам управления стрессом, эмоциональному регулированию и формированию здорового образа жизни. Наша цель — обеспечить долгосрочное восстановление и снизить риск возвращения к пагубным привычкам.Врачебный состав клиники “Ресурс здоровья” состоит из высококвалифицированных специалистов в области наркологии. Наши врачи-наркологи имеют обширный опыт работы с зависимыми пациентами и постоянно совершенствуют свои навыки.

Подробнее тут – нарколог вывод из запоя краснодар

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

Xrumer прогон для роста DR +50 по Ahrefs

I like reading through an article that will make people think.

Also, many thanks for permitting me to comment!

Химическая промывка пластинчактого теплообменника хороша тем, что для ее осуществления не нужно разбирать устройство http://chimtechservice.ru/

А раз в разборке нет необходимости, значит, и стоимость услуги существенно снижается http://chimtechservice.ru/ochistka_promyvka_teploobmennikov

Очищающие средства вводятся в теплообменник при помощи специального оборудования, которое имеется в арсенале мастеров нашей компании http://chimtechservice.ru/foto_obektov

Промывка паяных пластинчатых теплообменников http://chimtechservice.ru/

Химическая разборная промывка подразумевает разбор теплообменного устройства на пластины http://chimtechservice.ru/address

Чаще всего, разборная промывка применяется в случае, когда обслуживание теплообменника проводилось не регулярно http://chimtechservice.ru/cervisnoe_obsluzhivanie

Такой способ очистки пластинчатых теплообменников намного эффективнее безразборной промывки – он позволяет удалить самые плотные отложения с пластин и даёт максимальный эффект http://chimtechservice.ru/

Методы промывки http://chimtechservice.ru/ochistka_promyvka_kotlov

Альфа Лаваль (Alfa Laval)

Важность регулярного обслуживания http://chimtechservice.ru/postavka

Количество мест: 53 https://bus-standart.ru/gde-luchshe-ostanovitsya-dlya-otdyha-vo-vremya-dlitelnoj-avtobusnoj-poezdki/

Цена от: 2800 руб/час https://bus-standart.ru/avtobusy/do-60-mest/

Минивэн на 6-7 мест https://bus-standart.ru/avtobusy/avtobus-dlya-rabochih/

Совершили приятных безопасных поездок https://bus-standart.ru/moskovskaya-oblast/kolomna/page/2/

Цена от: 2800 руб/час https://bus-standart.ru/mikroavtobusy/na-svadbu/

Продолжительность поездки: 1 https://bus-standart.ru/stati/kak-pravilno-sostavit-raspisanie-dlya-avtobusnoj-ekskursii/

Проблемы:

Кроме того, в базе должны быть прописаны регламенты и инструкции для менеджеров , где содержатся ответы на все вопросы, которые могут возникнуть на каждом этапе продаж http://business-constructor.ru/

УПРАВЛЯЕМЫЙ ОТДЕЛ ПРОДАЖ Спроектирована и внедрена инфраструктура учета продаж, ведется отчетность и работает контроль качества http://business-constructor.ru/

Результат – автоматизированная и система получения эффективного менеджера без личного обучения и постоянного контроля http://business-constructor.ru/

Работа с отделом продаж всегда должна вестись глубоко http://business-constructor.ru/

Небольшие поверхностные изменения значимого эффекта не дадут http://business-constructor.ru/

Только такой подход дает результаты, которыми мы с клиентами гордимся!

Александр Никитин http://business-constructor.ru/

Мы можем предложить [b]дипломы[/b] любой профессии по приятным тарифам. Стараемся поддерживать для заказчиков адекватную политику цен. Для нас важно, чтобы [b]дипломы[/b] были доступными для большинства граждан.

Заказ [b]документа[/b], который подтверждает обучение в ВУЗе, – это выгодное решение. Заказать [b]диплом[/b] о высшем образовании: [url=http://network-89730.mn.co/posts/74472929/]network-89730.mn.co/posts/74472929[/url]

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервисные центры в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

скачать 888starz на телефон андроид https://androidonliner.ru/multimedia/888starz-ios-kak-skachat-i-ustanovit-prilozhenie-na-iphone

https://histor-ru.ru/wp-content/pgs/serialu_pro_turmu___zahvatuvaushiy_mir_za_resh_tkoy.html пятый канал телепрограмма на сегодня москва

https://pandorabox.ru/css/pgs/geroi_multserialov_v_kino.html фильм яйцо фаберже 2022 смотреть онлайн бесплатно в хорошем качестве

https://www.tenox.ru/wp-content/pgs/serialu_pro_shkolu__zahvatuvaushie_istorii__kotorue_stoit_posmotret.html смотреть модерн токинг клипы бесплатно онлайн в хорошем качестве

https://jaluzi-bryansk.ru/smarty/pags/filmu_onlayn_besplatno___dostupnoe_udovolstvie.html топ 100 мультфильмов всех времен

Уважаемые клиенты! Мы рады сообщить, что теперь вы можете заказать автомобили напрямую из Китая, Кореи и Японии!

Почему мы?

– Широкий выбор моделей от ведущих китайских, корейских, японских, европейских и американских производителей.

– Индивидуальный подбор автомобиля под ваши требования.

– Прозрачная схема работы и фиксированная стоимость.

– Быстрые сроки доставки.

– Полное сопровождение на всех этапах: от выбора до постановки на учет.

– Предоставление всех документов включая чеки за оказанные агентские услуги.

– Работаем официально.

Какие авто доступны?

– Легковые автомобили

– Внедорожники

– Коммерческий транспорт

– Электромобили

Как оформить заказ?

– Свяжитесь с нами по телефону.

– Укажите марку, модель и желаемые характеристики.

– Мы согласуем с вами все детали и сроки доставки.

– Официальные, безопасные, быстрые оплаты за поставляемые автомобили

– Дадим полную оценку автомобилю

Не упустите возможность приобрести надежный и современный автомобиль по выгодной цене!

– Звоните прямо сейчас

Тел +79644340397

Тел +79952187276

– Или пишите на почту

[email protected]

[email protected]

Ваш надежный партнер в мире автомобилей, ООО “ВТТ”

Авто из Китая в Россию

https://remontila.ru/art/filmu_onlayn_v_luchshem_kachestve.html мобиль де на русском языке

Современно одеваться важно, так как внешний вид помогает чувствовать себя комфортно.

Одежда формирует восприятие собеседников.

Удачный лук обеспечивает лёгкому общению.

Гардероб отражает характер.

Стильно составленная одежда и обувь повышает настроение.

http://psychotekst.pl/Forum/viewtopic.php?f=6&t=23802263

http://epidemics.ru/engine/pgs/istoricheskie_filmu_na_kinogo__kinoversiya_proshlogo.html играть бесплатно игра море слов

https://logospress.ru/content/pgs/?filmu_slesheru__istoriya__osobennosti_i_vliyanie_na_kulturu.html kinogo zone сериалы и фильмы

https://panamar.ru/mt/?filmu_onlayn___udobno__dostupno_i_uvlekatelno.html кинолорд фильмы онлайн смотреть бесплатно в хорошем качестве

Мы изготавливаем дипломы психологов, юристов, экономистов и прочих профессий по выгодным ценам. Стоимость может зависеть от конкретной специальности, года выпуска и образовательного учреждения. Всегда стараемся поддерживать для заказчиков адекватную ценовую политику. Для нас очень важно, чтобы документы были доступными для большинства наших граждан. сколько стоит дипломная работа

https://gefestexpo.ru/art/filmu_onlayn___novue_grani_kinoprosmotra.html кино владивосток расписание сеансов на сегодня

http://radiodelo.ru/shop/pgs/filmu__professionalu_svoego_dela.html анвап орг скачать фильмы музыку на телефон

888starz букмекерская контора https://zigry.net/skachat-prilozhenie-888starz-na-android/

https://www.evacuator-moskva.ru/images/pages/index.php?gangsterskoe_kino__istoriya__shedevru_i_kulturnoe_vliyanie.html анекдоты от никулина видео смотреть онлайн бесплатно в хорошем качестве

Сегодня мобильные технологии делают азартные развлечения еще более удобными и доступными. Теперь не нужно зависеть от браузера или искать альтернативные способы входа – все функции казино собраны в одном мобильном приложении. Оно поддерживает мгновенные транзакции, высокую скорость работы и удобный интерфейс, который позволяет легко переключаться между различными видами развлечений. Если вы хотите попробовать современные азартные игры без ограничений, вам необходимо 888starz скачать ios и зарегистрироваться. После установки пользователи получают доступ к бонусной программе, системе кэшбэка и персональным предложениям, которые позволяют увеличить выигрыши. В приложении представлены популярные игровые автоматы от ведущих разработчиков, лайв-игры с профессиональными крупье и возможность делать ставки на спорт в режиме реального времени. Кроме того, игроки могут воспользоваться удобными платежными методами, моментально пополнять баланс и выводить выигрыши без комиссии. В приложении предусмотрены специальные акции для мобильных пользователей, которые дают дополнительные фриспины и бонусные средства за активность. Теперь играть можно в любое время суток и из любой точки мира – скачайте клиент, пройдите авторизацию и начните выигрывать уже сегодня. Пользователи могут настраивать систему уведомлений, чтобы не пропускать выгодные акции и эксклюзивные турниры с крупными призами. Вся финансовая информация защищена современными технологиями шифрования, что гарантирует безопасность каждой транзакции. Теперь ваше казино всегда с вами – установите клиент и испытайте свою удачу прямо сейчас!

http://www.kramatorsk.org/images/pages/?filmu_shedevru_hbo__istoriya__vliyanie_i_unikalnue_chertu.html омск иртышское расписание электричек на сегодня

«Красноярский сэндвич» г http://business-constructor.ru/

Красноярск http://business-constructor.ru/

Отдел продаж под ключ – это:

Федоров Дмитрий http://business-constructor.ru/